How To Secure A Lead Investor

You’ve created an amazing founding team, you’ve built a brilliant product that has been gaining a lot of traction, and now you’re looking to expand your company. How do you continue to build your business? By searching for a lead investor in your next funding round.

The lead investor is the first step in the process that makes the rest of the process take flight. The primary responsibilities of a lead investor is to invest, advise and attract other sources of capital for your business. There are so many financial opportunities with a lead investor on board, so searching for one will definitely provide a lot of value to your company.

Below is a list of ways to identify a lead investor, build a relationship, close the deal, and everything in between for your next funding round.

What Is A Lead Investor?

A lead investor is a company’s principal capital provider. Lead investors play a much more critical role than that of any other investor. Regardless of what round, whether that be the angel round, venture round or hedge fund, finding a lead investor can be invaluable to a company.

There are certainly many paths towards acquiring funding, but having a lead investor can prove to be beneficial. For instance, when a lead investor takes the lead in representing a funding round, they can influence follower investors to get on board and thus increase the value of the funding round. Beyond finance, lead investors can also offer invaluable advice towards the company’s growth.

How To Identify A Lead Investor

The key to identifying prospects to become the lead investor in your round, is to do your homework. Most founders think that just any investor has the potential to help lead their funding round. This couldn’t be further from the truth. The key is to find an investor that has some type of experience in your industry, so they will quickly understand the problem that you are solving, and your solution. Investors that fit the descriptions below will more likely be willing to meet with you to discuss your company:

-

Has either previously invested in, founded, or been an early employee at a company in your industry

-

Invests in companies at your stage, whether it is seed stage, series A or beyond

If you make the mistake of pursuing investors that have no experience in your industry, you will create a much harder road for yourself, because they will not have the natural sense of empathy for your company and industry. In the post titled “How to Find a Lead Investor,” by Nitin Pachisia, who is a founding partner of Unshackled, gives a great example of this advice in action saying:

3 Qualities Lead Investors Must Have

According to Adeo Ressi, below are the three qualities that you should look for in a potential lead investor:

Interest in Your Segment

Financial Resources

Time and Risk Readiness

These qualities limit the number of people, but guarantee you a great lead investor for your company. And remember, before finding a lead investor you are going to speak to at least 50 potential investors, 20 of which may be interested in your company, and 10 of which may actually invest. You may get lucky if you secure a lead investor before speaking to 50 prospective benefactors, but those are rare cases.

Do Not Get Blacklisted From Lead Investors

If you are looking for funding but do not have your pitch or company in good shape, you will be blacklisted. When you get a “no” from an investor, that “no” is forever. The average investor sees dozens, if not hundreds of deals a month. There are some cases in which investors may look at your company again, but don’t count on it. Also, if you make a bad impression with one investor, there’s a good chance that they will pass the word along to fellow investors, which will hurt your chances for potential meetings with others.

Glen Hellman, a serial entrepreneur and angel investor, provided a list of the offenses that will put you on the investor blacklist in his post, “Have You Been Blacklisted By Investors?”:

How To Build A Relationship With An Investor

Adeo Ressi, Founder and CEO of the Founder Institute tells us some simple truths about lead investors.

If you can convince them to believe in you then the benefits that you will reap are priceless. They will play an extremely important role in the success of your company.

This is not to mention that they are usually the largest investor in your funding. Your job is to start a relationship with that investor and eventually convert them to be a lead. This starts with you making the first contact and reaching out to them. During this process, Ressi lays out a very important rule that he urges you to follow:

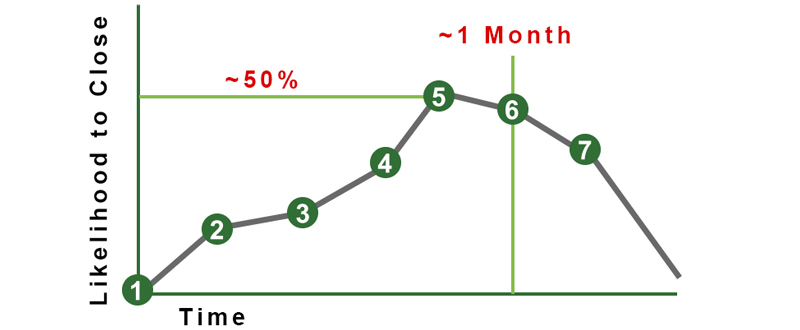

This means that you have to build a relationship with the investor before you ever ask them for funding. Here is the chain of interactions that Ressi, who’s raised venture capital for multiple companies and now has his own VC fund, suggests that you have with an investor that you’d like to invest in your company. Notice that asking for funding doesn’t come until the 6th step.

1. Meet

2. Invite to Coffee

3. Send a New Update

4. Meet at an Event

5. Dinner Invite

6. Funding Ask

7. News Update

Here is Ressi’s graph, that corresponds with your chances of getting a “Yes” walking through these steps.

Getting A Yes From Your Lead Investor

Remember to only ask for funding once you’ve had 5-6 interactions with your potential lead investor and are at least 50% sure that they’ll say yes. If they say “Maybe” or “I’ll think about it,” then you’ll want to send them a news update after they give you this response. If you don’t get a “Yes,” from them after sending a news update than your chances of getting them to say “Yes” in the future will steadily decrease.

But while pursuing a lead investor, it’s important to not forget that your main goal with each meeting is to get another meeting until you feel confident enough that you can ask them for money. Once you are ready to ask them, you’ll want to phrase the question in a way that won’t directly elicit a “Yes” or “No” response. Here’s are some examples of types of questions that you can ask:

- “Would you be interested in helping the company grow by leading the next round of financing?.”

- “Would you be interested in advising us on how to grow?”

- “Would you be interested in advising the company on how to grow, and leading our round of financing?”

Turn Your Lead Investor Into An Advisor

Finding the right advisor can be tricky. If your startup is at the stage of looking for funding, chances are you already have a few. But a good tactic for getting great advice from someone invested in you is granting your lead investor an advisor position. As you’ve already learned, your lead investor’s expertise and connections should be in your market domain, therefore having them as an advisor would be greatly beneficial for you and your company. Adeo Ressi says:

Compensation provides additional motivation for your lead to follow through with their investment and be vigilant in helping you. Compensating the lead with an Advisor Position can be distributed through “Advisory Shares”. Typically these shares will be .5% to 2.5% in options vested over 2 years – and can be tailored to the input of your advisor and the stage of your company. And there is an easy, lawyerless way to carry this agreement out.

The Founder Institute has created what we call the Founder/ Advisor Standard Template or “FAST”. The FAST document offers a way to quickly allow founders and advisors to work collaboratively without going through the cumbersome legal drafting often required to divide shares. Now compensating your advisor is as easy as checking a few boxes and signing the dotted line. This way everyone wins.

Furthermore, when securing your lead, you should control the terms of the agreement through an convertible equity round. This way not only do you propose the terms sheet and draft the final agreement, but you also don’t leave the burden (and cost) of drafting the documents needed to the lead investor. You also avoid the downsides of convertible debt.

Build Buzz For Your Funding Round

Before you close a deal with a lead investor, make sure that you create a balancing act between developing buzz and maintaining or increasing your growth metrics.

Plan a series of company internal milestones and send monthly updates in a newsletter. Organize at least one public announcement before close and secure partnerships for external validation.

Ensure that metrics are moving upward. Though you may be hustling during this period of time, try not to neglect the business. Even if you obtain a lead and plan to close in two to three months, an investor won’t hesitate to pull out if your metrics tank. Make sure you’re hustling to close, creating buzz, getting press, and growing your metrics all at the same time to decrease chances of failure.

Closing The Deal For Your Funding Round

In closing the deal, you are going to need a strong lawyer or company counsel engaged to help with setting the terms and valuation for your company. Make sure the terms are agreed upon; meeting the minimum closing amount, minimum investment amount, and closing date.

Here are some examples:

- Minimum closing amount: “We won’t close this angel round with less than $250,000.”

- Minimum investment amount: “The minimum to invest in the round is $20,000.”

- Initial closing date: “We’re going to target the closing date on November 13th.”

The “maximum amount with a rolling close” is less necessary these days, because it’s easy to hurt your business by setting a max with investors. Adeo claims:

Be careful when thinking about a max amount. If two million dollars worth of interest rolls in, throw away the team sheet, find a new lead, and restructure the terms. Adeo adds that, “in an ideal world, you have 5 to 6 investors and you may get up to 10. I recommend convertible equity right now, pretty much universally, because the equity deals are harder to do.”

Raising money is definitely a hard task and there are no shortcuts, but if implemented successfully it can be very rewarding. With fundraising outlets like AngelList and Gust to help source investors for your next funding round, remember that the core of securing an investment is building relationships. Always be patient and prepared with your pitch, so that when an opportunity presents itself, you’ll be sure to secure your lead investor.

Like this article?

How To Secure A Lead Investor

By Paula Taas

Comments