What Is a Business Model?

In The New, New Thing, Michael Lewis refers to the phrase business model as “a term of art.” And like art itself, it’s one of those things many people feel they can recognize when they see it (especially a particularly clever or terrible one) but can’t quite define.

That’s less surprising than it seems because how people define the term really depends on how they’re using it.

Lewis, for example, offers up the simplest of definitions — “All it really meant was how you planned to make money” — to make a simple point about the dot.com bubble, obvious now, but fairly prescient when he was writing at its height, in the fall of 1999. The term, he says dismissively, was “central to the Internet boom; it glorified all manner of half-baked plans … The “business model” for Microsoft, for instance, was to sell software for 120 bucks a pop that cost fifty cents to manufacture … The business model of most Internet companies was to attract huge crowds of people to a Web site, and then sell others the chance to advertise products to the crowds. It was still not clear that the model made sense.” Well, maybe not then.

A look through HBR’s archives shows the many ways business thinkers use the concept and how that can skew the definitions. Lewis himself echoes many people’s impression of how Peter Drucker defined the term — “assumptions about what a company gets paid for” — which is part of Drucker’s “theory of the business.”

That’s a concept Drucker introduced in a 1994 HBR article that in fact never mentions the term business model. Drucker’s theory of the business was a set of assumptions about what a business will and won’t do, closer to Michael Porter’s definition of strategy. In addition to what a company is paid for, “these assumptions are about markets. They are about identifying customers and competitors, their values and behavior. They are about technology and its dynamics, about a company’s strengths and weaknesses.”

Drucker is more interested in the assumptions than the money here because he’s introduced the theory of the business concept to explain how smart companies fail to keep up with changing market conditions by failing to make those assumptions explicit.

Insight Center

Citing as a sterling example one of the most strategically nimble companies of all time — IBM — he explains that sooner or later, some assumption you have about what’s critical to your company will turn out to be no longer true. In IBM’s case, having made the shift from tabulating machine company to hardware leaser to a vendor of mainframe, minicomputer, and even PC hardware, Big Blue finally runs adrift on its assumption that it’s essentially in the hardware business, Drucker says (though subsequent history shows that IBM manages eventually to free itself even of that assumption and make money through services for quite some time).

Joan Magretta, too, cites Drucker when she defines what a business model is in “Why Business Models Matter,” partly as a corrective to Lewis. Writing in 2002, the depths of the dot.com bust, she says that business models are “at heart, stories — stories that explain how enterprises work. A good business model answers Peter Drucker’s age-old questions, ‘Who is the customer? And what does the customer value?’ It also answers the fundamental questions every manager must ask: How do we make money in this business? What is the underlying economic logic that explains how we can deliver value to customers at an appropriate cost?”

Magretta, like Drucker, is focused more on the assumptions than on the money, pointing out that the term business model first came into widespread use with the advent of the personal computer and the spreadsheet, which let various components be tested and, well, modeled. Before that, successful business models “were created more by accident than by design or foresight, and became clear only after the fact. By enabling companies to tie their marketplace insights much more tightly to the resulting economics — to link their assumptions about how people would behave to the numbers of a pro forma P&L — spreadsheets made it possible to model businesses before they were launched.”

Since her focus is on business modeling, she finds it useful to further define a business model in terms of the value chain. A business model, she says, has two parts: “Part one includes all the activities associated with making something: designing it, purchasing raw materials, manufacturing, and so on. Part two includes all the activities associated with selling something: finding and reaching customers, transacting a sale, distributing the product, or delivering the service. A new business model may turn on designing a new product for an unmet need or on a process innovation. That is it may be new in either end.”

Firmly in the “a business model is really a set of assumptions or hypotheses” camp is Alex Osterwalder, who has developed what is arguably the most comprehensive template on which to construct those hypotheses. His nine-part “business model canvas” is essentially an organized way to lay out your assumptions about not only the key resources and key activities of your value chain, but also your value proposition, customer relationships, channels, customer segments, cost structures, and revenue streams — to see if you’ve missed anything important and to compare your model to others.

Once you begin to compare one model with another, you’re entering the realms of strategy, with which business models are often confused. In “Why Business Models Matter,” Magretta goes back to first principles to make a simple and useful distinction, pointing out that a business model is a description of how your business runs, but a competitive strategy explains how you will do better than your rivals. That could be by offering a better business model — but it can also be by offering the same business model to a different market.

Introducing a better business model into an existing market is the definition of a disruptive innovation. To help strategists understand how that works Clay Christensen presented a particular take on the matter in “In Reinventing Your Business Model” designed to make it easier to work out how a new entrant’s business model might disrupt yours. This approach begins by focusing on the customer value proposition — what Christensen calls the customer’s “job-to-be-done.” It then identifies those aspects of the profit formula, the processes, and the resources that make the rival offering not only better, but harder to copy or respond to — a different distribution system, perhaps (the iTunes store); or faster inventory turns (Kmart); or maybe a different manufacturing approach (steel minimills).

Many writers have suggested signs that could indicate that your current business model is running out of gas. The first symptom, Rita McGrath says in “When Your Business Model is In Trouble,” is when innovations to your current offerings create smaller and smaller improvements (and Christensen would agree). You should also be worried, she says, when your own people have trouble thinking up new improvements at all or your customers are increasingly finding new alternatives.

Knowing you need one and creating one are, of course, two vastly different things. Any number of articles focus more specifically on ways managers can get beyond their current business model to conceive of a new one. In “Four Paths to Business Model Innovation,” Karan Giotra and Serguei Netessine look at ways to think about creating a new model by altering your current business model in four broad categories: by changing the mix of products or services, postponing decisions, changing the people who make the decisions, and changing incentives in the value chain.

In “How to Design a Winning Business Model,” Ramon Cassadesus-Masanell and Joan Ricart focus on the choices managers must make when determining the processes needed to deliver the offering, dividing them broadly into policy choices (such as using union or nonunion workers; locating plants in rural areas, encouraging employees to fly coach class), asset choices (manufacturing plants, satellite communication systems); and governance choices (who has the rights to make the other two categories of decisions).

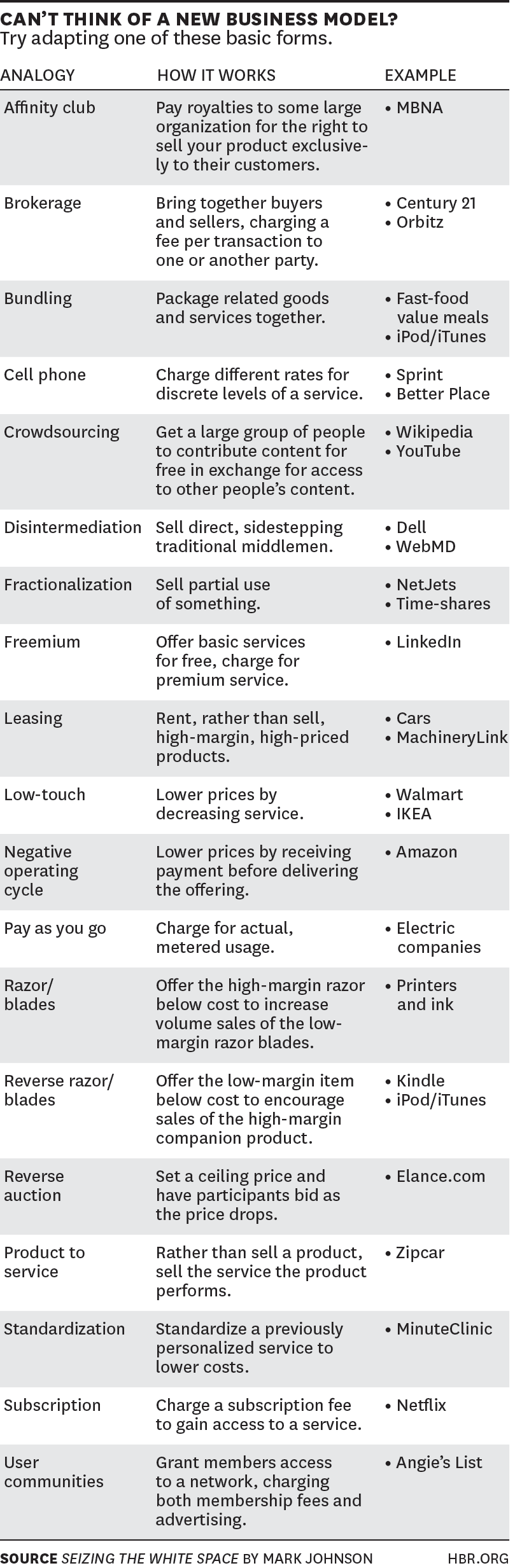

If all of this has left your head swimming, then Mark Johnson, who went on in his book Seizing the White Space to fill in the details of the idea presented in “Reinventing Your Business Model,” offers up perhaps the most useful starting point — this list of analogies, adapted from that book: