Silicon Valley Legend Creates Pitch Deck Template For Entrepreneurs

Peter Thiel cofounded Paypal with Elon Musk and Max Levchin in 1998. They sold this company to eBay in a deal worth over $1B. He then founded several other ventures such as Palantir which has been included in the unicorn club (companies with over $1B in valuation).

In addition, Thiel is also very active on the other side of the table as he serves as president of Clarium Capital, a global macro hedge fund with $700 million in assets under management; a managing partner in Founders Fund, a venture capital fund with $2 billion in assets under management; co-founder and investment committee chair of Mithril Capital Management; and co-founder and chairman of Valar Ventures

However, when it comes to investing in startups his most popular investment to date was the angel investment he made into Facebook. His initial investment of $500K was worth over $1B upon the company going public in 2012. Without a doubt a very nice return as an early stage investor. However, if he would have waited a bit longer to unload his stock that investment could have been worth much more. At the moment in which Thiel sold his shares, Facebook was worth $100B. Nowadays the current value of Facebook is $342B.

Some of Thiel‘s other portfolio investments in early stage companies include Booktrack, Slide, LinkedIn, Friendster, Rapleaf, Geni.com, Yammer, Yelp Inc., Powerset, Practice Fusion, MetaMed, Vator, IronPort, Votizen, Asana, Big Think, Caplinked, Quora, Rypple,TransferWise, Nanotronics Imaging, Stripe, and Legendary Entertainment.

Thiel wrote the template example below of a pitch deck on a hardware device for founders to learn from. It was written in 2012, but surprisingly I haven’t seen anyone share it before. I find the template very interesting but perhaps a bit short. If you want a more robust pitch deck template you can use for free the one I created below.

Furthermore, I cover pitch decks extensively throughout chapter 4 of my book The Art of Startup Fundraising. As described in the book, a killer pitch deck should include the following slides:

- Problem

- Solution

- Market Size

- Product

- Traction

- Team

- Competition

- Financials

- Amount being raised

With that being said, lets go ahead and take a look at the pitch deck template from Peter Thiel.

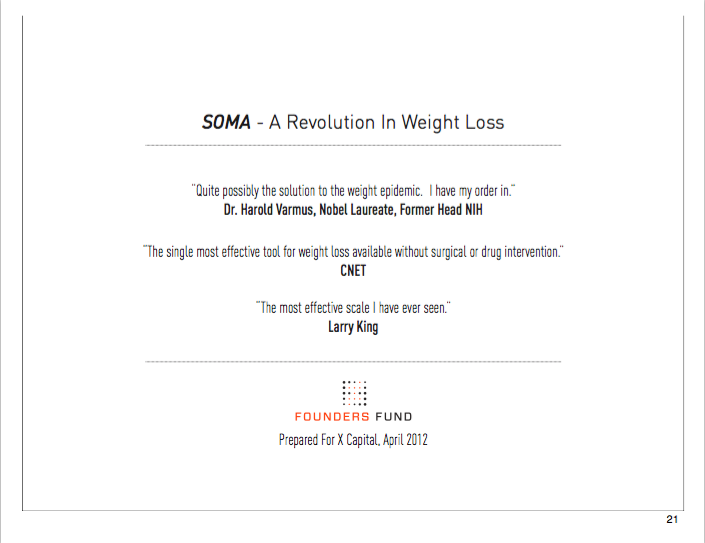

THE COVER

The quotes from media outlets are very interesting. They give trust and add social proof to your venture. For any investor reviewing your slides this will give instant credibility. On average an investor will take around 2 minutes and thirty seconds to review a pitch deck. By having credible sources you will most likely increase the attention and investment of time on your materials.

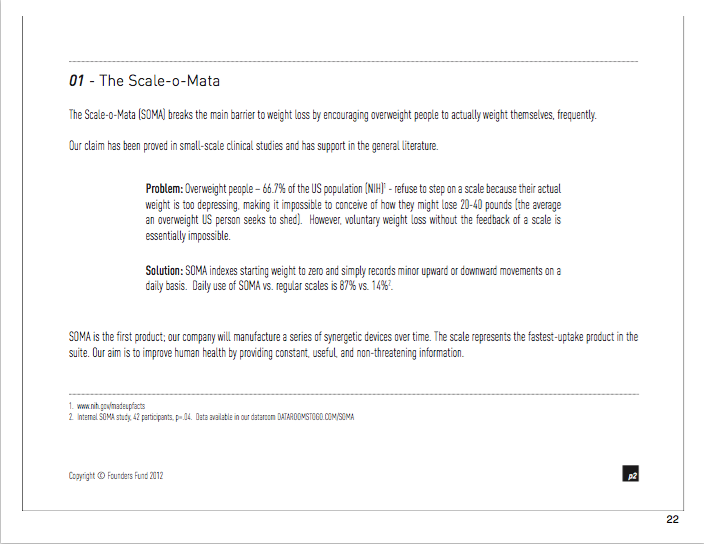

PROBLEM AND SOLUTION

Normally I would recommend startups to create different slides for the problem and the solution as you don‘t want to overwhelm the investor in one slide. However, I find Thiel did a great job at summarizing all the information in one single place.

What I really like about this approach is that on the second slide of this pitch deck the investor knows right away what the company is all about and the problem is trying to solve.

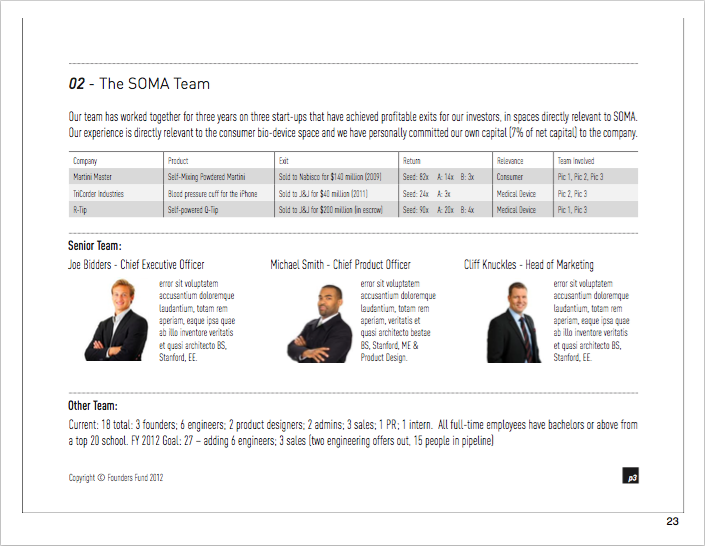

THE TEAM

The team is probably one of the most important slides in any pitch deck. The investor wants to know who is driving the bus and what makes them so unique to execute on that mission and vision. Note there are at least 100 other people that have also thought about your same idea. For that reason idea is 10% and 90% is from execution.

If you have the right people seated on the right seats of the bus the company will end up finding its direction to success/

With this in mind, I can appreciate why Thiel highlighted the exits of each one of the founders. Unfortunately when you are investing in a first time founder you are also investing in that individual‘s education and all the mistakes he or she will make during the early days. This is always part of the journey and there is no way to go around it.

Having the founder experience and domain expertise helps in reducing the risk from an investment and that is something you absolutely need to include on the slide just like Peter Thiel did.

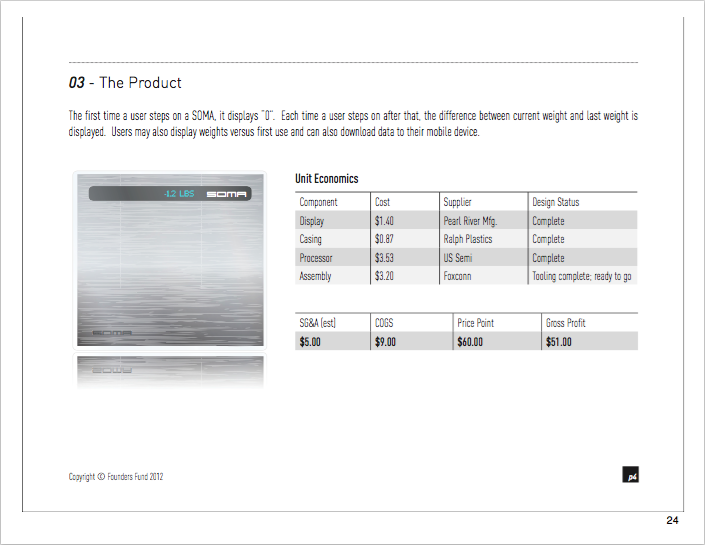

THE PRODUCT

I like the way unit economics are displayed and the stage in which things are at. This reminds me as well that you should definitely include a slide covering traction. Either on this slide or on a separate one. Investors want to know what kind of acceptance your venture has received from the market and if you are ready to scale the business with the capital you are looking to raise.

Many founders make the mistake with raising capital to start the company. This ultimately results in taking unnecessary dilution right out of the gate.

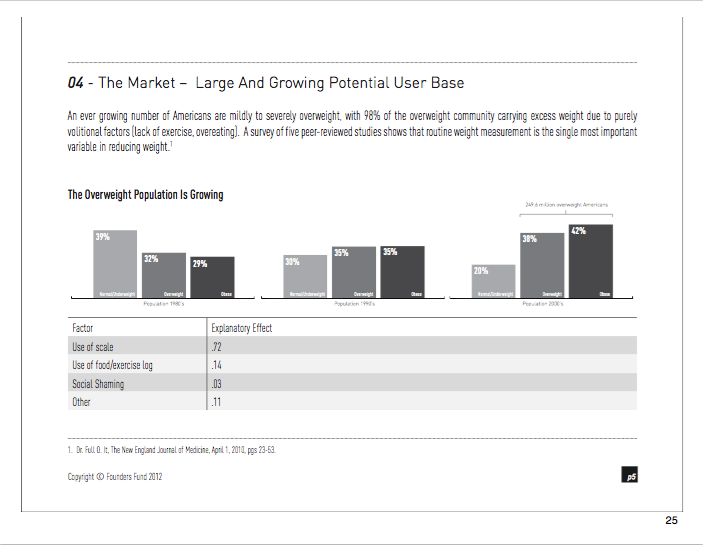

THE MARKET

The market is going to determine the potential exit of the investor. If you are operating in a small market also the returns could be impacted by this. I like how Thiel walks the person that is reading this slide through the growth that such market is experiencing over time.

Including sources from research papers and nice good looking graphs that are increasing over time is a plus on this section.

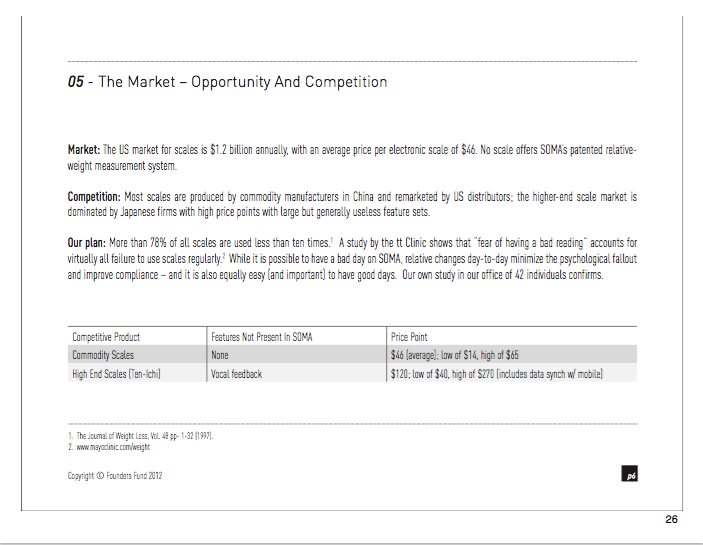

OPPORTUNITY AND COMPETITION

In my opinion this slide could be repetitive keeping in mind the information of the previous slide. This information could have been summarized and added to the previous slide. I prefer to have this slide showcasing all the competitors in a diagram where you set yourself apart from all the other companies clearly outlining what makes you unique.

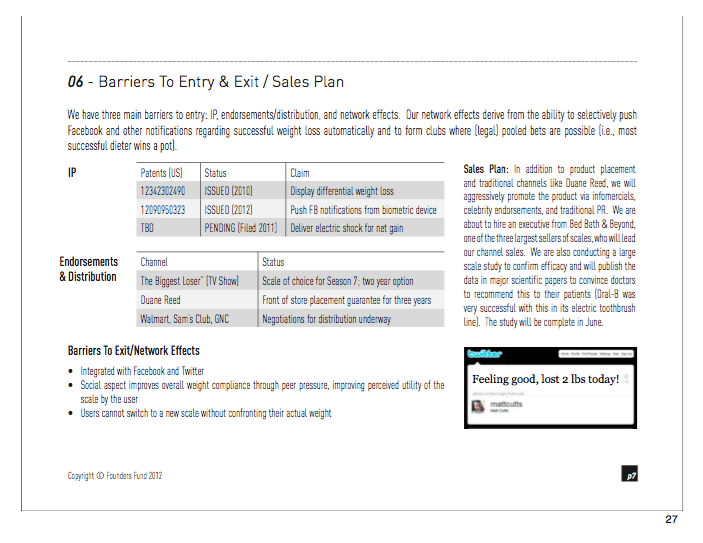

BARRIERS TO ENTRY

I find Thiel did a phenomenal job with this slide. One of the main concerns of investors is the competitive advantage that your company has over the other players in your space. What makes you unique? How will you be able to outperform your competitors? This could be done either by distribution channels, partnerships, or intellectual property. Make sure you include this information on your pitch deck in a very clear way.

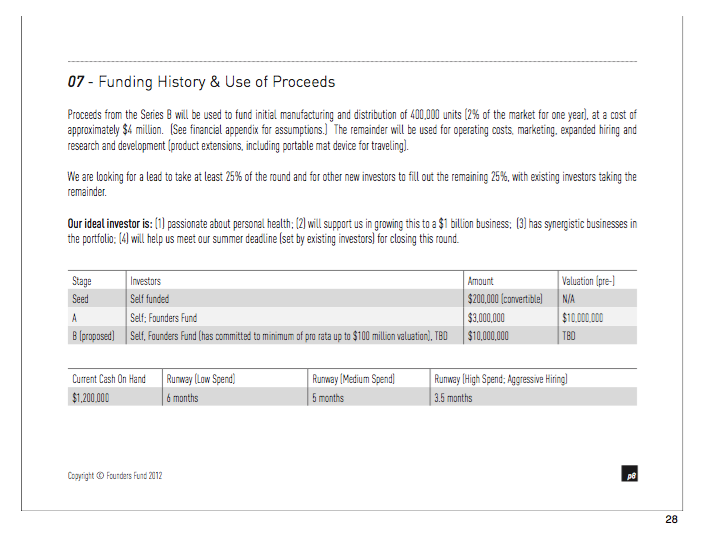

FUNDING HISTORY

Just like Thiel does on this slide, investors want to know who else is part of your company. I find investors like to follow others. In the event you have high profile investors that have invested in your company, ask them for permission to include them or their logo in this slide. This will definitely help with increasing the trust with prospects.

Moreover, it is great to see on this slide the use of proceeds. Why are you raising the capital and what you intend to do with it? This will be the type of questions that you will be getting during the fundraising process. Perhaps saying what you have accomplished with the past rounds of financing will provide an idea of what your team is capable of.

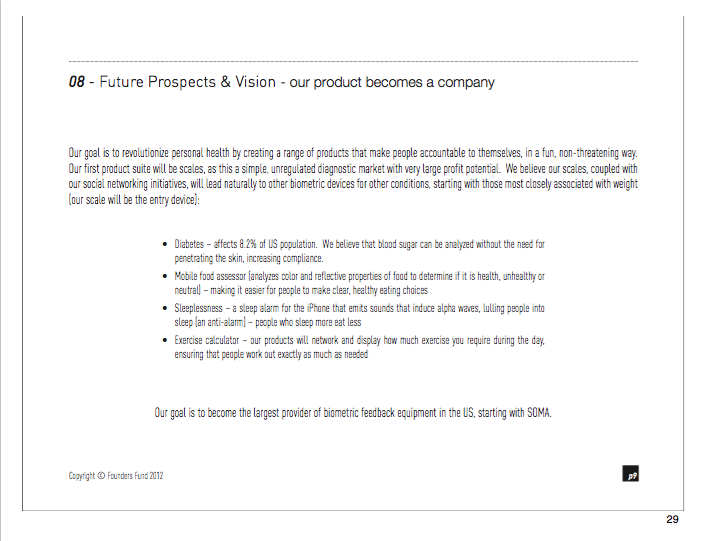

FUTURE PROSPECTS & VISION

Some people like to see this at the beginning. I am not sure why it was included at the end of the pitch deck but the vision of the company is critical. Without a proper vision and having the team aligned around it there is no way you will find success with your venture.

CONTACT

I very much like the access details to the data room that Thiel provides on this slide. Entrepreneurs need to anticipate future steps and potential questions.

I find that providing the data room details upfront helps in accelerating the process of getting funded as it takes out the back and forth with document requests and other type of information required to make a decision on the investor end. You can use Dropbox or Google Drive for this.

If you are interested in knowing what to include inside the data room and how to organize folders I dedicate chapter 5 of my book to this (feel free to buy on Amazon here).

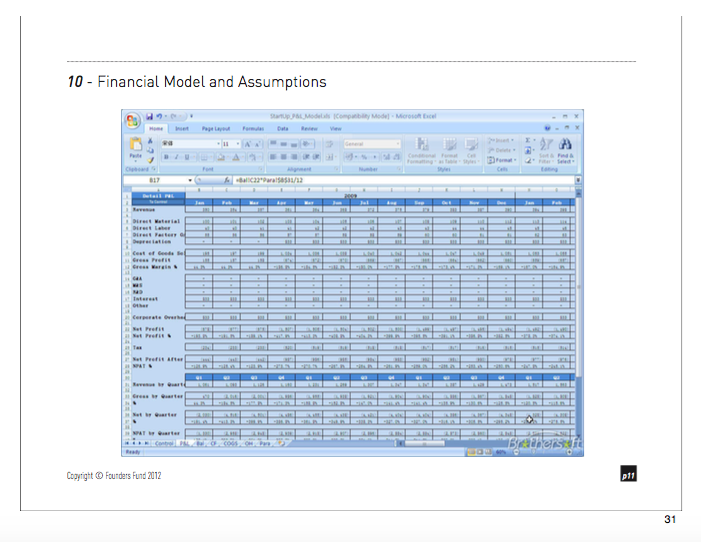

FINANCIAL MODEL

This is the slide investors spend the most amount of time on. I would perhaps include this slide before the ask or the amount of funding you are seeking. If you take a look at my post Study Reveals The Pitch Deck That Will Land You Millions, you will see that from a study conducted on over 200 pitch decks 23% of the reviewing time on a pitch deck will be allocated to this specific slide.

Financial projections are a shot in the dark when you are a startup. No one knows where you will be in 3 to 5 years from today. However, this slide serves as a roadmap and gives a good idea to the investor on where things are headed. It also shows how grounded you and your management team are. In the event you are not a financial guy, I would highly recommend that you have an expert taking a look at your financials before you send them out to investors.

The financials that you would need to include in the pitch deck are just a screen shot. Thiel included a ton of information. I would just include a simple overview and then the rest as appendix just like Square did on its pitch deck. You can see Square‘s pitch deck on the post that I published a few weeks ago under the title 38 Startup Pitch Decks From Companies That Changed The World.

I would recommend using the Startup Investment Return Calculator of 1000 Angels. You can leverage the calculator during fundraising conversations to help investors understand what potential IRR (internal rate of return) and Cash on Cash return they could make by investing in your startup.

Conclusion

Overall it is a great pitch deck that touches on some of the things I cover on the Fundraising Certification, which is a 3 week comprehensive course on fundraising for entrepreneurs. Note I would use a version of this only for emails to investors tho. The reason for this is mainly due to the fact there is a lot of text to digest. If you were to be presenting in front of investors you want them to connect with you during the presentation.

LEARN MORE ABOUT THE FUNDRAISING CERTIFICATION HERE

With that being said, I would create another version for your pitch deck with less text and more visuals in the event you need to present in front of investors.

Moreover, I would have added two more slides to this pitch deck covering traction and the amount being raised. I also don‘t think it is a good idea to disclose your runway on the slides as you never know who will have access to this type of information. Have this type of discussions in an intimate setting once you trust that investor.

To conclude this post, I find it would be very helpful for others if you could share on the comment section below what has worked for you during fundraising. Perhaps there is some information or slides that you suggest to add or to take out from the pitch deck presented in this post. Look forward to hearing your thoughts!